Downstream

The Company has completed a number of major modernisation projects across its oil refineries in Kazakhstan and Romania, successfully achieving higher refining depths. The Company’s plans for the mid-term include:

- for Kazakhstan refineries: to drive operational excellence through cost optimisation and higher oil product output by reducing losses and fuel consumption for operational needs

- for Romania refineries: to improve performance by increasing the output of higher-margin products while cutting refining costs through streamlining and digitising production processes, optimising the product slate to achieve higher sales margins for refined products, and sustaining dividend payments to the KMG Corporate Centre

- integrated petrochemical projects: under its trusteeship agreements, KMG implements two major investment projects:

- construction of the first integrated petrochemical complex with a capacity of 500 ths tonnes of polypropylene per year, to be commissioned in 2021

- construction of a 1.25 mtpa polyethylene plant (currently at the design stage).

Oil and condensate marketing

In 2020, sales of own oil and condensate produced by KMG amounted to 22,012 ths tonnes, including 15,161 ths tonnes of oil exports, and 6,851 ths tonnes of domestic oil supplies. Supplies to KMG refineries in Kazakhstan are fully included into domestic oil supplies: 2,925 ths tonnes to Atyrau Refinery, 2,939 ths tonnes to Pavlodar Refinery, 542 ths tonnes to Shymkent Refinery and 427 ths tonnes to CASPI BITUM. The year-on-year decline in performance was mainly due to lower oil production and consumption as a result of the

| Assets | 2018 | 2019 | 2020 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Export | Domestic market | Total | Export | Domestic market | Total | Export | Domestic market | Total | |

| Operating | 8,773 | 6,980 | 15,752 | 8,472 | 7,137 | 15,609 | 7,524 | 6,849 | 14,373 |

| including subsidiaries and | 5,367 | 3,303 | 8,670 | 5,325 | 3,453 | 8,778 | 4,911 | 3,514 | 8,425 |

| | 7,971 | 12 | 7,983 | 8,215 | 1 | 8,216 | 7,637 | 2 | 7,639 |

| Total | 16,744 | 6,991 | 23,735 | 16,688 | 7,138 | 23,826 | 15,161 | 6,851 | 22,012 |

KMG refining assets

Within KMG’s asset mix, four refineries in Kazakhstan and two in Romania are responsible for processing liquid hydrocarbons (primarily oil).

Prospective projects and innovations

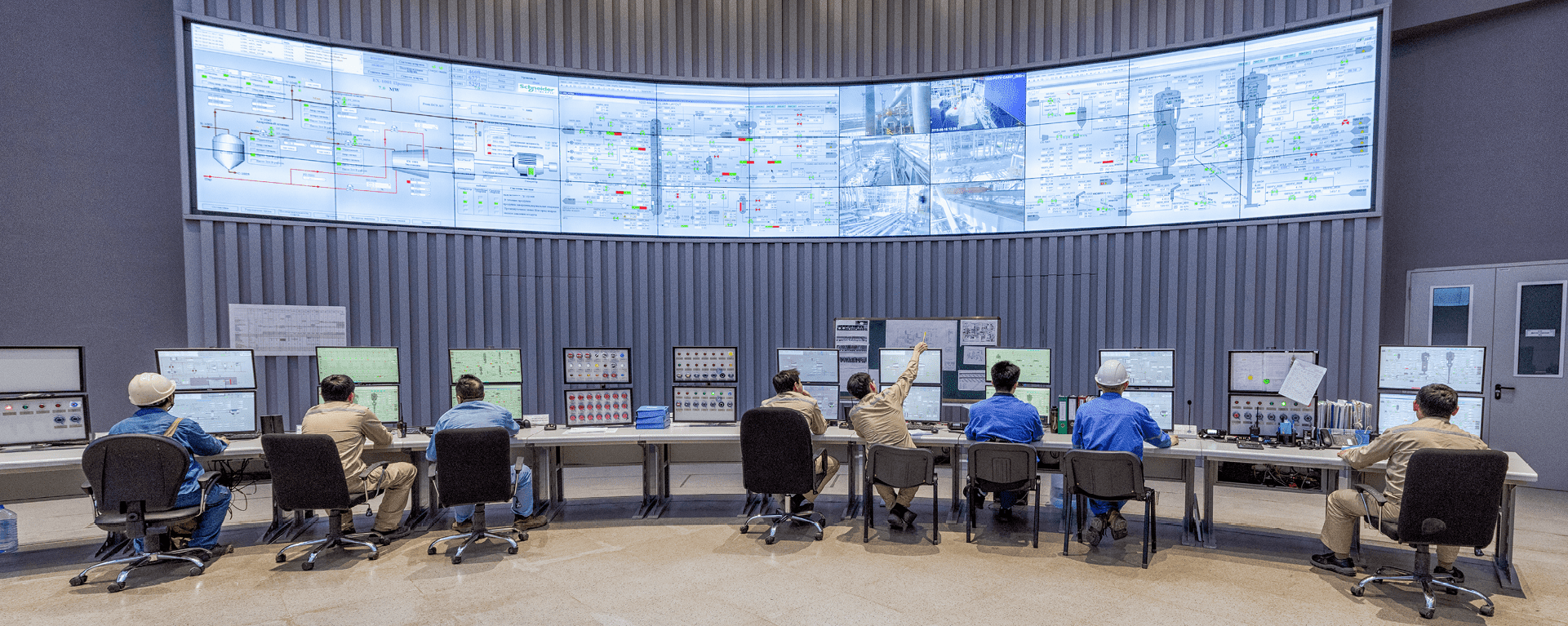

In March 2020, Atyrau Refinery completed the roll-out of an optimised process control system at its AT-2 unit, delivering a number of positive effects such as increasing the output of straight-run petrol and diesel by 0.32% and 0.36%, respectively, reducing the percentage of light components in fuel oil by 0.2%, cutting mode switching times, and achieving overall process stabilisation. Plans for 2021 include the roll-out of the optimised process control system to the AVT-3 unit.

JV CASPI BITUM LLP started upgrading its bitumen oxidation and blending units to increase bitumen output by 50%; the upgrade projects were approved by the State review board.

The refinery builds a Digital General Plan and 3D model. The project aims to create high-precision digital general plans of oil refineries through laser scanning and 3D modelling along with a system to collect, analyse, process, store, manage and visualise integrated engineering data.

The refinery has started adopting local engineering models. The project aims to streamline refining processes and drive process debottlenecking by modelling process units, and will help to better predict equipment performance as well as cut operating expenses.

| Indicator | Kazakhstan refineries | Romania refineries | ||||

|---|---|---|---|---|---|---|

| Atyrau Refinery | Pavlodar Refinery | Shymkent Refinery | CASPI BITUM | Petromidia Refinery | Vega Refinery | |

| Location | Atyrau | Pavlodar | Shymkent | Aktau | Năvodari | Ploiești |

| Commissioning date | 1945 | 1978 | 1985 | 2013 | 1979 | 1905 |

| Design refining capacity, mln tonnes | 5.5 | 6.0 | 6.0 | 1.0 | | 0.5 |

| Hydrocarbon refining volumes in 2020, mln tonnes | 5 | 5 | 4.8 | 0.87 | | 0.36 |

| Refinery utilisation rate in 2020, % | 91 | 83 | 80 | 87 | 81 | 72 |

| KMG interest, % | 99.53 | 100 | 49.72 | 50 | 54.63 | 54.63 |

| Nelson Index | 13.9 | 10.5 | 8.2 | – | 10.5 | – |

| Light product yield in 2020, % | 59 | 69 | 82 | – | 86.01 | – |

| Refinery co-owners | – | – | CNPC | CITIC | Romanian Government | Romanian Government |

Tariff policy

Kazakhstan refineries only offer oil refining services using the set tariffs (processing business scheme) and do not purchase crude for refining or sell refined products. Oil suppliers market finished products independently. The refineries focus exclusively on the operations side, streamlining refining activities and reducing operating expenses.

Oil refining tariffs at Kazakhstan refineries factor in actual production-related operating expenses and an investment component (capital expenditures to maintain current production rates, repayment of loans raised for modernisation).

| Refinery | 2018 | 2019 | 2020 |

|---|---|---|---|

| Atyrau Refinery | 33,810 | 37,436 | 41,168 |

| Pavlodar Refinery | 17,250 | 19,805 | 20,904 |

| Shymkent Refinery | 19,579 | 24,485 | 30,783 |

| CASPI BITUM | 18,008 | 18,010 | 18,003 |

Refining volumes at Kazakhstan refineries

Hydrocarbon refining and production of oil products

In 2020, hydrocarbon refining volumes at Kazakhstan refineries (net to KMG) amounted to 12,849 ths tonnes, with oil product output at 11,707 ths tonnes. Year-on-year, hydrocarbon refining and production of oil products were down by 7%, mainly due to the negative impacts of the COVID-19 pandemic which has weakened demand for fuel and led to lower refinery throughput rates, as well as scheduled maintenance and repairs at Atyrau and Pavlodar Refineries. Despite these headwinds, KMG fully covered domestic demand for light products in 2020.

| Refinery | 2018 | 2019 | 2020 |

|---|---|---|---|

| Atyrau Refinery | 5,268 | 5,388 | 5,016 |

| Pavlodar Refinery | 5,340 | 5,290 | 5,004 |

| Shymkent Refinery (50%) | 2,366 | 2,701 | 2,397 |

| CASPI BITUM (50%) | 409 | 443 | 433 |

| Total | 13,384 | 13,822 | 12,849 |

| Oil products | 2018 | 2019 | 2020 |

|---|---|---|---|

| Atyrau Refinery | 4,742 (100%) | 4,892 (100%) | 4,525 (100%) |

| | 2,857 (60%) | 2,998 (61%) | 2,737 (60%) |

| | 1,589 (33%) | 1,590 (33%) | 1,383 (31%) |

| | 33 (1%) | 166 (3%) | 250 (6%) |

| Other | 263 (6%) | 138 (3%) | 155 (3%) |

| Pavlodar Refinery | 4,854 (100%) | 4,794 (100%) | 4,609 (100%) |

| Light | 3,552 (73%) | 3,600 (75%) | 3,438 (75%) |

| Dark | 1,007 (21%) | 894 (19%) | 896 (19%) |

| Other | 295 (6%) | 300 (6%) | 275 (6%) |

| Shymkent Refinery (50%) | 2,151 (100%) | 2,477 (100%) | 2,145 (100%) |

| Light | 1,507 (70%) | 2,028 (82%) | 1,970 (92%) |

| Dark | 643 (30%) | 447 (18%) | 172 (8%) |

| Other | 1 | 2 | 3 |

| Caspi Bitum (50%) | 405 (100%) | 439 (100%) | 428 (100%) |

| Dark | 154 (38%) | 185 (42%) | 185 (43%) |

| Other | 251 (62%) | 254 (58%) | 243 (57%) |

| Total | 12,152 | 12,602 | 11,707 |

Production and marketing of oil products derived from KMG’s own oil

JSC OzenMunaiGas, JSC Embamunaigas, Kazakhturkmunay LLP and Urikhtau Operating LLP supply Atyrau and Pavlodar Refineries with KMG’s own crude oil, and the resulting refined products are subsequently sold wholesale domestically or for export.

In 2020, OzenMunaiGas, Embamunaigas, Kazakhturkmunay and Urikhtau Operating supplied 3,517 ths tonnes of crude oil for refining, including 2,178 ths tonnes to Atyrau Refinery and 1,339 ths tonnes to Pavlodar Refinery. The two refineries’ combined output for the year was

KMG sells oil products wholesale after the oil purchased from OzenMunaiGas, Embamunaigas, Kazakhturkmunay and Urikhtau Operating is refined at Atyrau and Pavlodar Refineries. In 2020, KMG sold 3,167 ths tonnes of oil products, primarily petrols, diesel fuel and fuel oil (78%).

The bulk of oil products was sold domestically (2,160 ths out of 3,167 ths tonnes), and the remainder was exported (1,007 ths tonnes). The share of oil product exports was up 6% year-on-year, an increase of 203 ths tonnes, driven by higher exports of light products amidst weaker domestic demand.

In the domestic market, 1,217 ths tonnes of petrol and diesel fuel were shipped to the retail chain of filling stations operated by PetroRetail LLP, 198 ths tonnes of diesel fuel to agricultural producers, 46 ths tonnes of fuel oil for heating needs of social and production facilities and institutions, and 430 ths tonnes of oil products to third parties, while 134 ths tonnes of petrol, diesel fuel and jet fuel and 40 ths tonnes of fuel oil were delivered to

| Oil products | Atyrau Refinery | Pavlodar Refinery | Total | Average oil product wholesale prices over 12M 2020, KZT per tonne |

|---|---|---|---|---|

| Light | 1,092 | 817 | 1,909 | 147,341 |

| Dark | 589 | 234 | 823 | 66,636 |

| Petrochemicals | 110 | 0 | 110 | 111,740 |

| Other | 114 | 176 | 290 | 32,282 |

| Total | 1,905 | 1,228 | 3,133 | 114,031 |

Refining in Romania

The core business of KMG International is hydrocarbon refining, as well as wholesale and retail sales of oil products. The KMG International-owned Petromidia Refinery is responsible for primary hydrocarbon refining, with the Vega Refinery focusing on secondary refining. The Petromidia and Vega Refineries operate according to the model where refineries purchase hydrocarbons for their own account, refine them and then sell them either wholesale or retail through an owned retail network of filling stations.

KMG International also owns a major petrochemical complex producing polypropylene and low- and high-density polyethylene (LDPE and HDPE). In addition, KazMunayGas Trading AG, the trading subsidiary of KMG International, is focused on trading in crude oil and oil products produced by KMG International refineries or by third parties.

In 2020, our refineries in Romania processed 5,228 ths tonnes of hydrocarbons and other feedstocks and produced 5,110 ths tonnes of oil products. The volumes decreased by 23% year-on-year on average, largely due to the scheduled temporary shutdown of the Petromidia Refinery for maintenance between mid-March and May 2020 (the maintenance was successfully completed within 45 days, amid a lockdown, with no incidents or COVID-19 cases), unfavourable weather in the Black Sea region and at the Port of Midia in winter, which had a negative impact on supplies of crude oil and straight-run gas oil, and lower demand for refined products as a result of the COVID-19 pandemic.

| Refinery | 2018 | 2019 | 2020 |

|---|---|---|---|

| Petromidia Refinery | 5,925 | 6,331 | 4,864 |

| Vega Refinery | 406 | 436 | 364 |

| Total | 6,331 | 6,767 | 5,228 |

| Refinery | 2018 | 2019 | 2020 |

|---|---|---|---|

| Petromidia Refinery | 5,788 | 6,172 | 4,749 |

| | 4,903 | 5,225 | 4,009 |

| | 687 | 736 | 575 |

| Other | 198 | 211 | 165 |

| Vega Refinery | 397 | 442 | 361 |

| Dark | 102 | 120 | 123 |

| Other | 295 | 321 | 238 |

| Total | 6,185 | 6,614 | 5,110 |

As a result of the COVID-19 pandemic, the demand for crude oil and oil products dropped to all-time lows, with surplus supply of oil products to the market during the lockdown. The refining margin (the difference between the actual market prices for all oil products and actual market prices for feedstocks weighted against yield targets) remained negative since May.

| Unit | 2018 | 2019 | 2020 |

|---|---|---|---|

| USD per tonne | 47.4 | 31.7 | –5 |

| USD | 6.2 | 4.2 | –0.7 |

In 2020, crude oil volumes for resale marketed through KMG International’s trading operations totalled 8.5 mln tonnes. The 22% reduction was due to the fall in demand amid the COVID-19 pandemic.

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Crude oil for resale | 12,535 | 10,911 | 8,522 |

KMG International’s retail network

As demand fell during the pandemic, KMG International’s performance was mostly driven by retail sales. Despite a weaker market demand, KMG International’s market share in the Romanian retail market grew by 0.9% year-on-year (15.71% in the end of December 2020 vs 14.81% in December 2019) in 2020.

At year-end 2020, KMG International’s retail network was comprised of the following assets:

- Romania: 284 filling stations and 779 points of sale (DOEX, RBI and Cuves) 10 CODO, 3 DODO, 13 DOEX, 11 RBI and 65 Cuves stations were opened

- Neighbouring countries: 254 filling stations and points of sale, including 60 stations in Bulgaria (new 8 DOCODO and 1 DODO), 102 stations in Georgia (6 new stations in key regions, including the first flagship COCO station in Borzhomi) and 92 stations in Moldova (5 new DOCO stations).