Competitive advantages

Unique geography

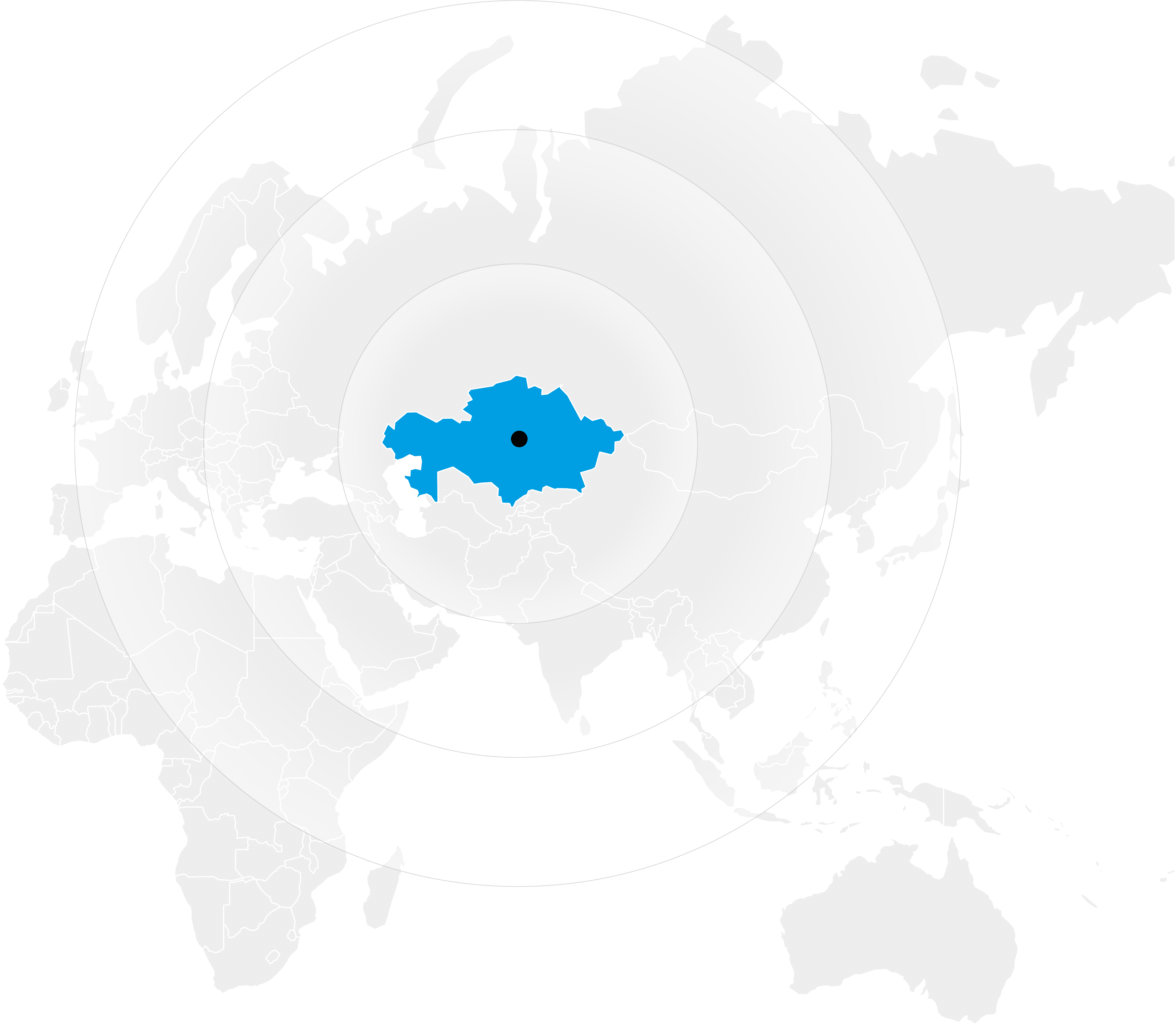

Kazakhstan has an extensive resource base, favourable location, and a unique opportunity to export to Europe and fast-growing Asian markets, including China.

Kazakhstan’s economy has grown nine-fold over the last 20 years due to political and social stability, natural resources development, and boosting industrial infrastructure.

The oil and gas industry is the leading economic sector in Kazakhstan. The oil and gas sector contributes significantly to Kazakhstan’s aggregate income from taxes and exports and remains a key investment destination. Foreign direct investment (FDI) into the industry was higher than USD 70 bln over the last decade. The wide presence of global energy majors promotes Kazakhstan as an attractive investment region. In 2019, Kazakhstan was ranked 12th globally in terms

Full integration across the value chain

KMG is the national leader in Kazakhstan’s oil and gas industry with a fully integrated added value chain. As a national leader and a vertically integrated company, KMG has a strong foundation supporting its long-term sustainable development. KMG’s assets comprise an entire hydrocarbon added value chain including exploration, production, transportation, refining, and marketing. The Company operates in Kazakhstan and Romania.

Financial stability

Thanks to major efforts to maintain KMG’s financial stability undertaken over several years, the Company was better prepared for new challenges in 2020 than in previous periods of low oil prices. Specifically, following a 34.8% year-on-year decline in the average Dated Brent oil price to USD 41.8 per bbl in 2020, EBITDA amounted to USD 2,785 mln, compared to 2015, when the average Dated Brent oil price was USD 52.37 per bbl, down 47.1% year-on-year, and EBITDA was negative at USD 670 mln

Differentiated upstream portfolio

KMG has a diversified portfolio of oil and gas production assets with an attractive growth potential. We also have a unique access to new licences and oil and gas assets in Kazakhstan to sustain inorganic growth.

KMG partners with international companies for major oil and gas projects on a global scale with a potential to boost hydrocarbon production: Tengiz, Kashagan and Karachaganak. Operating assets are mainly mature fields with stable production levels, and production efficiency improvement is a key objective for the Company.

Leading position in Kazakhstan’s midstream sector

KMG has a 56% share of Kazakhstan’s oil transportation market and a 79% share of its gas transportation market.

The oil transportation system managed by KMG is well-diversified and has a high transit and export potential. The active investment phase in this segment has been completed, and the capacities have been ramped up to meet the needs of growing production volumes in Kazakhstan.

Advanced oil refineries

The Company operates the four largest refineries in Kazakhstan and two in Romania. As a result of their comprehensive modernisation, KMG improved refining depth. Domestic demand for high-quality light products was fully covered. Moreover, our production capacities allow us to export a part of our oil products.

Advanced corporate governance framework and commitment to sustainable development principles

Sustainable development is a strategic priority for KMG. Over the past few years, the Company has progressed significantly in its ESG development, as evidenced by the dynamics of environmental and social performance along with achievements in improving the corporate governance framework.

KMG’s environmental agenda prioritises GHG emissions, water and production waste management, flaring reduction, land remediation and energy efficiency.

We promote meritocracy, fairness, and integrity while providing every employee with a workplace conducive to new achievements and assessing their respective contributions to KMG’s overall success based on merit. We are implementing the Leadership programme and the Mentoring, Coaching, Training programme along with plans to strengthen corporate culture and enhance social stability and industrial relations.

The Company strives to comply with international best practices and places a particular emphasis on continuous improvement of its corporate governance framework. The current composition of the Board of Directors is optimally balanced in terms of competencies to enable quality decision-making. Three out of seven Board members are independent directors, three are nominated by the major shareholder, and one is an executive director (Chairman of the Management Board). All Committees of the Board of Directors are chaired by independent directors.