Performance under investment projects

Transition to portfolio and project management

Aimed at effectively achieving strategic goals under KMG’s Development strategy the Company started a transition to portfolio-based investment management in 2019. Respective guidelines were developed in 2020, with the process for embedding portfolio and project management approaches successfully launched during the year.

Portfolios are managed by ranking projects and prioritising high-impact strategic projects to efficiently allocate the financial resources available to the Company and increase competition for investment opportunities among businesses.

The project management process aims to improve the quality of planning and implementation of investment projects by applying best practices in project management from the global oil and gas industry.

The Company is phasing in Stage Gate Process projects and the Value Assurance Review to assess projects in line with the industry’s best practices. Key project roles were also introduced, and their functions and responsibilities assigned.

More than 1,000 employees of KMG Group were trained to handle the new project management system and underwent a basic project management course. Training in project management methods and tools is ongoing.

A project management solution based on Microsoft Project Server 2019 was launched to generate the register of projects run by KMG and its subsidiaries and associates.

In 2021, we plan to further develop project management, including through drafting guidelines for individual subject areas of project management and establishing project offices at KMG and its subsidiaries and associates while upskilling and accrediting project teams.

Investment portfolio overview

In 2020, KMG’s investment activity was substantially affected by the

As oil prices were declining, KMG took crisis response measures across the board to maintain its own stability. As a result, decisions were approved to continue the most promising projects involving domestic or foreign partners to share the risks.

Responding to the crisis required a more careful and balanced approach to our investment projects. Like many large companies around the world, KMG took measures to cut its CAPEX. Development CAPEX budgeted for 2020 were reduced by KZT 29 bln, with relevant cost optimisation for 2020–2024 planned to total KZT 65 bln.

Upstream

A considerable portion of KMG’s investment portfolio relates to oil and gas exploration and production projects. These projects are funded both directly by KMG and in conjunction with strategic partners on a parity basis. For example, several offshore projects are implemented on the basis of carry financing (Abay, Isatay, Zhenis, l-P-2, Bekturly Vostochny), where capital investments at the exploration stage are borne only by KMG’s strategic partners. In the event of hydrocarbons discovery, KMG and its partners finance production at subsequent stages of the project implementation.

Al-Farabi (l-P-2) is one of such projects. In October 2020, KMG and PJSC LUKOIL (“LUKOIL”), its strategic partner, signed an agreement on the

As part of its crisis response strategy, KMG optimised its exploration portfolio by exiting certain projects.

In December 2020, two wells were brought into pilot operation at the East Urikhtau field in the Aktobe Region as part of the Urikhtau project. This phase provides for bringing into operation two wells at the East Urikhtau field and five wells at the Central Urikhtau field in December 2021. If the wells prove successful at the first phase, and if the market conditions are favourable, the Company will consider moving on to the second phase, under which 58 wells will operate at the Urikhtau group of fields and a number of production facilities will be constructed. The Urikhtau group of fields is located in the Mugalzhar District of the Aktobe Region and includes the Central Urikhtau, East Urikhtau and South Urikhtau. JSC NC KazMunayGas is a founder and the only member of Urikhtau Operating LLP.

In November 2020, the facilities of the Construction of an APG Desulphuriser for the Prorva Group of Fields project was officially commissioned, offering an additional capacity of 150 mln m3 per year. The project was implemented under the Programme for 100% utilisation of associated petroleum gas. The unit is designed to recover APG from the Prorva group of fields (S. Nurzhanov, West Prorva, Aktobe, Dosmukhambetovskoye) in the Zhylyoi District (Atyrau Region). Once commissioned, the unit will produce commercial gas, commercial granulated sulphur and stable gas condensate. More than 500 temporary jobs were created by the contractor during the construction.

KMG has interests in joint ventures developing large oil and gas fields such as Tengiz (20%), Karachaganak (10%) and Kashagan (8.44%):

- At Tengiz it is implementing the Future Growth Project – TCO Wellhead Pressure Maintenance Project, which will increase production capacity to 12 mtpa, bringing TCO’s total oil output to around 39 mtpa.

- Projects at Kashagan aim to ramp up oil production through increased raw gas reinjection and redistribution of the gas injection zone to other drilling islands.

- Karachaganak’s ongoing projects aim to maintain the liquid hydrocarbon production plateau at

10–11 mtpa , by increasing existing gas treatment and reinjection systems and drilling new production and injection wells.

Oil and gas transportation

Oil transportation

Oil transportation is a strategic segment in KMG’s asset portfolio to maintain access to oil markets. We have built a diversified oil transportation system with a high transit and export capacity.

In 2020, the Company was implementing two projects:

- The flow reversal project at the Kenkiyak–Atyrau oil pipeline (reversing the flow to carry oil from Atyrau to Kenkiyak and beyond). The first start-up complex has been commissioned. In December 2020, a mechanical completion report of the facilities of the second start-up complex was signed. The project is part of the construction and development of the Kazakhstan–China oil pipeline system. Its commissioning will enable the reverse transportation of up to 6 mln tonnes of oil per year from Western Kazakhstan fields to Pavlodar and Shymkent refineries, as well as for export to China.

- A project to remove bottlenecks in Caspian Pipeline Consortium’s (“CPC”) oil pipeline system, approved by shareholders in July 2019. The project will increase the capacity of the Kazakhstan section within the Tengiz–Astrakhan–Novorossiysk pipeline to 72.5 mtpa, with a view to expected higher oil production from Tengiz and Kashagan. The project is slated for completion before the end of 2023.

Gas transportation and marketing

In 2020, the construction of the Beineu–Bozoi–Shymkent gas pipeline achieved its major goal – to transport up to 15 bln m3 of gas per year from the western fields of Kazakhstan, supply gas to the southern regions of Kazakhstan and diversify gas exports. As part of this objective, a number of related projects were completed in 2020:

- Construction of four compressor stations at the Beineu–Bozoi–Shymkent gas pipeline. In April 2020, the last compressor station,

Ustyurt (KS-1A) , in the Baiganin District of the Aktobe Region was commissioned as part of the project. The commissioning of the Ustyurt compressor station brings the number of compressor stations installed along the gas pipeline to four. With the completion of this particular project, the annual capacity of the Beineu–Shymkent gas pipeline has increased to 15 bln m3, enabling uninterrupted supply of natural gas to the southern regions of the country during winter peak periods as well as increased gas exports - Increased gas storage capacity at the Bozoi underground gas storage facility. The project aims to increase gas storage capacity at the Bozoi underground gas storage facility from 2.2 bln m3 to 4 bln m3 and comprised two phases:

- The completion of Phase 1 reached a storage capacity of 3 bln m3 as at year-end of 2017 and accelerated gas injection to 150 days from 270 days and gas withdrawal period to 180 days

- Implementation of Phase 2 involved revamping five gathering stations and constructing two new gathering stations as well as bringing annual gas storage capacity to 4 bln m3. The project was commissioned in December 2020.

Once the Beineu-Shymkent gas pipeline was commissioned, the Bozoi underground gas storage facility became an important element in the supply of natural gas to consumers in the Turkestan, Zhambyl and Almaty Regions.

Under the Development of the Amangeldinskaya Group of Fields project, further progress was made on the Barkhannaya–Sultankuduk exploration cluster in 2020, with the seismic programme scheduled for completion in 2021.

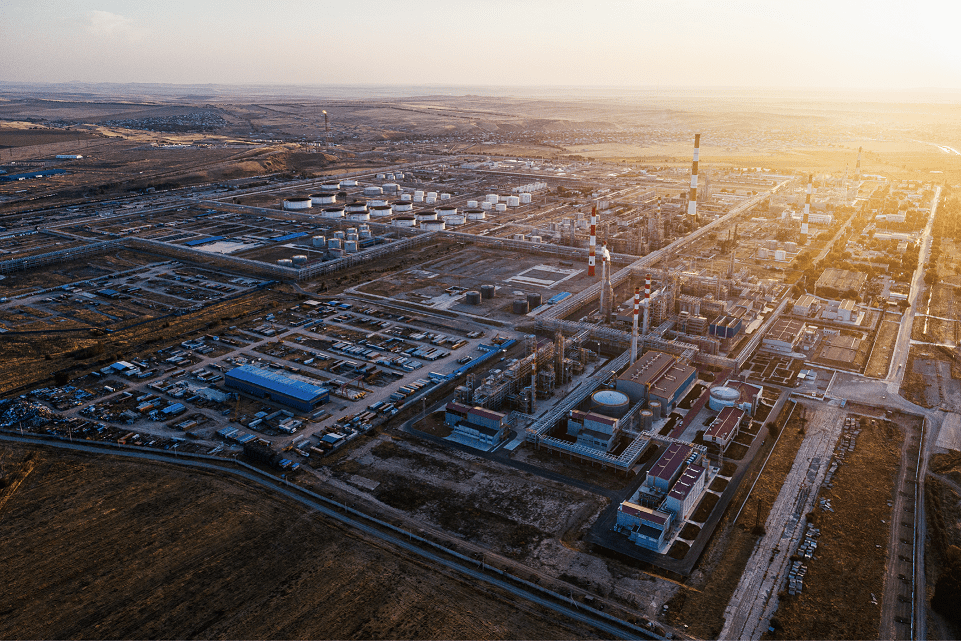

Refining and marketing of oil products

The Kazakh-Romanian Fund KMG International N.V. continues the construction of 25 filling stations (Phase 1) in Romania to build a retail network for the sale of oil products. 10 out of 25 filling stations were already commissioned under the project, with the rest planned to be launched in 2021.

Kazakhstan refineries are also engaged in a number of relevant projects.

Pavlodar Refinery completed a feasibility study for its ERTIS project, which allow producing winter diesel fuels with a cloud point of –28 °C or lower.

As a socially responsible company and in line with its commitments to environmental transparency, Atyrau Refinery, a wholly-owned subsidiary of KMG, started the upgrade of its wastewater treatment facilities as part of the Tazalyq project in 2020. The treatment facilities are planned to be upgraded in three phases: upgrade and renovation of the first mechanical wastewater treatment train in 2019–2022, renovation of the biological wastewater treatment facility and construction of an advanced treatment facility, and land reclamation in 2019–2023.

The project will halve discharges to evaporation fields through recirculating of treated water back into the refinery’s processes by 50%, with water withdrawal from the Ural River cut by 30%.

Service projects

KMG’s service projects are not capital heavy, offer quick returns and are mainly focused on enhancing oilfield services provided to major oil and gas assets.