Strategic priorities

The existing KMG 2018–2028 Development Strategy focuses on creating value and reinforcing financial stability.

Priorities of the KMG 2018–2028 Development Strategy

Create value and improve financial stability

As part of this priority, KMG focuses on its core operations seeking to drive organic growth and improve operations across all key segments.

The Company plans to expand opportunities for oil production and improve production from existing assets while continuing to adopt advanced technology and implementing digitalisation projects across its fields. We are also intending to expand our oil and gas resource base to ramp up our international and domestic supplies of hydrocarbons and oil products. To effectively leverage its oil and gas transportation potential and enhance its exports and transit businesses, the Company is committed to optimising the use of its oil and gas pipeline networks.

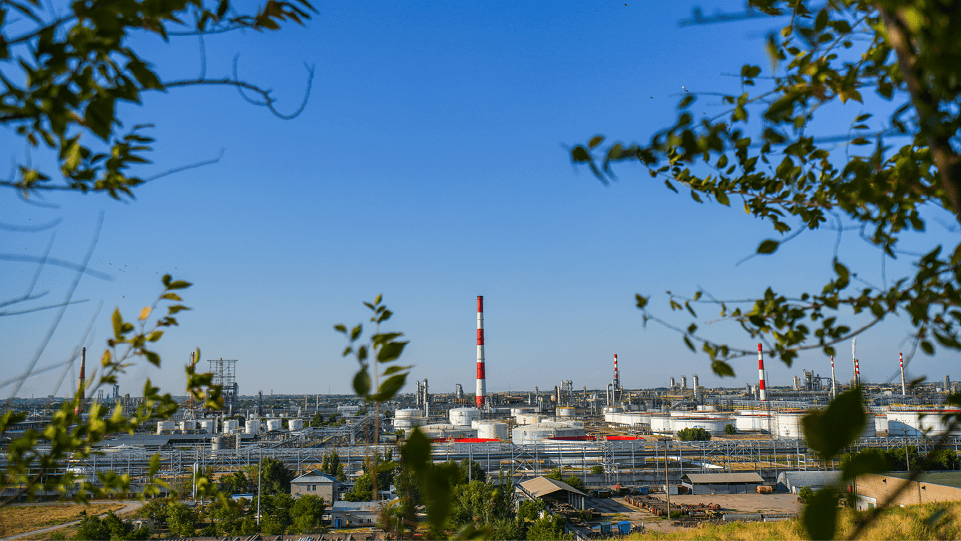

As a result, KMG has achieved a strategic milestone for Kazakhstan fully meeting the domestic demand for oil products through the upgrade of its local refineries. Moreover, our production capacities allow us to export a part of our oil products. The upgrade also facilitated our sales of greener fuels resulting in lower emissions by end consumers.

The Company carefully selects and prioritises investment projects, considering only highly effective strategic projects for investments.

The Company is committed to prudent capital allocation policy and focuses on maximisation of shareholder return through the cycle. Value creation remains a priority development area for KMG.

We also embrace the need for accelerated digital transformation to address global challenges faced by the oil and gas industry. In 2020, net benefits from the Transformation programme came at KZT 9.3 bln, outstripping the targets by close to 127%.

KMG has chosen a pragmatic approach focusing on specific production targets in Exploration and Production, Transportation and Refining to improve operational efficiency, equipment reliability, health and safety and environmental performance as well as digital skills of KMG employees. In 2021, the Company will continue initiatives launched in 2020.

The 2020 crisis had a significant impact on KMG’s performance. To respond promptly, the Company developed and launched its crisis response strategy for 2020–2021. The initiatives partially offset the negative impact while enabling the Company to maintain its financial stability and ensure smooth operation of its subsidiaries without any cash gaps. We will continue our crisis response efforts regarding cost optimisation in 2021.

The Company seeks to adhere to a conservative financial policy maintaining a balanced debt profile and securing a strong liquidity position.

Since KMG was assigned to the red zone of credit risk, a Roadmap was drafted and approved by KMG’s Board of Directors in 2020 to move KMG into the green zone through improving operational efficiency across KMG Group (by increasing EBITDA), managing debt and preventing liquidity shortages. As a result of this work, the Company was able to reduce the consolidated debt of KMG Group and maintain KMG’s credit ratings from Moody’s, Fitch and S&P.

Streamline the business and management models

KMG is a holding company that guides the strategic development of KMG Group, with its core operations concentrated across its subsidiaries.

KMG takes measures to improve the operating model by optimising business processes across KMG Group, including business process re-engineering and production optimisation through digital transformation tools. The optimisation has become even more pressing in view of our crisis response efforts.

To ensure effective operation of the holding company, KMG also implements the privatisation and divestment programmes to exit non-core and non-strategic businesses.

The privatisation programme is implemented by KMG under the Comprehensive Privatisation Plan for

The Divestment Plan covers 58 assets, with 10 out of them successfully divested and 48 assets remaining to be divested in 2028.

Embed best practices in corporate governance and sustainable development

KMG is committed to aligning its operations with sustainability principles and economic, environmental and social goals. The Company seeks to be in the top quartile across all ESG metrics and integrated ESG goals within the framework of strategic and medium-term KPIs for executives. The Company recognises its important social commitments inspired by principles of partnership with its employees and trade unions.

KMG’s Code of Business Ethics approved in 2020 outlines the Company’s corporate values and defines the key principles and rules of business conduct as well as requirements of corporate ethics binding on all employees. KMG focuses on improving transparency of its operations and adhering to high corporate governance standards. The Company is intending to continue monitoring the evolution of global standards to further improve its corporate governance framework while catering to the interests of all stakeholders.

As part of implementing best practices in sustainability, KMG has received its first international rating from Sustainalytics. The high rating assigned by the agency confirms KMG’s strategic commitment and responsibility to present and future generations in environmental and social sustainability matters, as well as its continuous improvements to corporate governance.

KMG continues to work actively on its commitment to the 17 global Sustainable Development Goals (SDGs). In 2020, we started integrating the SDGs into our business processes.